Engaging Stakeholders Effectively

in the Double Materiality Process

Anna Helena Chaim

5 min Read Time | April 8th 2025

Understanding how sustainability issues affect business performance—and how operations impact society and the environment—has become a strategic priority for companies worldwide. This dual perspective, known as double materiality

[1]

, helps businesses navigate an evolving landscape where stakeholder expectations and market demands are increasingly intertwined.

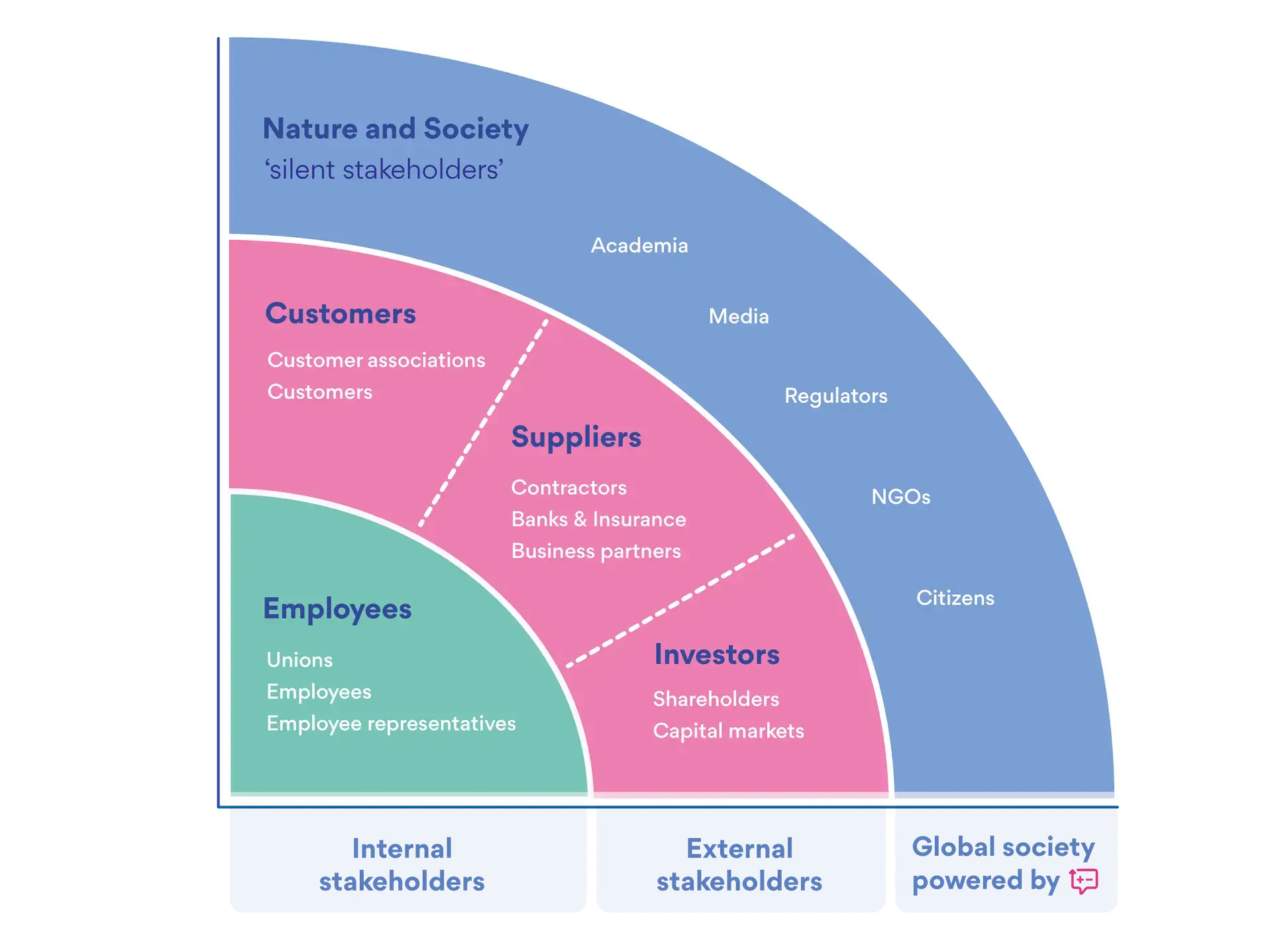

Stakeholder engagement is the bridge that connects these two dimensions. By fostering a two-way flow of information, stakeholders—from employees and investors to communities and NGOs—provide critical insights that help companies identify risks, uncover opportunities, and align their strategies with broader societal and environmental goals

[4]

. This dynamic process ensures that sustainability reporting evolves from a box-ticking activity into a powerful driver of transparency, trust, and transformation.

The business case is clear: 88% of European institutional investors have increased their use of ESG information in investment decisions over the past year

[3]

. Beyond attracting capital, effective engagement fosters innovation, strengthens reputation, and helps businesses adapt to fast-changing consumer and regulatory expectations

[4]

.

In the following sections, we’ll explore how stakeholder engagement brings double materiality to life, why it matters for strategic decision-making, and how companies can implement best practices to maximize its value—for their business and society at large.

Stakeholder Engagement Bridges The Gap Between Financial and Impact Materiality

The two dimensions of Double Materiality are not separate or parallel concepts but are deeply intertwined [6, p2] . Stakeholder engagement and impact assessment uncover issues that companies might not initially recognise as financially material, leveraging the severity and urgency of these impacts, which might otherwise remain hidden or underestimated by internal assessments [6, p27] .

For example, on the topic of Working Conditions, a company may not immediately see the financial risks tied to inadequate wages or unsafe environments for contracted workers—issues strongly labeled as impact material [5, p8] . However, through stakeholder feedback, such as from employees, partners, or civil society assessments, these concerns may emerge as material to the company’s financial performance.

Different stakeholder groups offer unique insights that, when combined, strengthen the DMA [6, p27] . For example, employees and workers in the value chain can highlight immediate concerns such as work safety or fair wages, drawing from their direct experience with day-to-day operations. Consumers and end-users (external stakeholders) may focus on ethical labour sourcing or brand reputation, reflecting market expectations and consumer values. Meanwhile, civil society or affected communities can shed light on systemic issues, such as the long-term consequences of precarious employment on community well-being, the regional implications of labor rights violations, and overall public perception. Together, these perspectives create a more complete picture of how working conditions—or any impact topic—translate into financial risks and opportunities. In other words, this multi-stakeholder approach ensures a deeper, more comprehensive understanding of materiality [6, p26, 27] .

Then, this collective engagement approach enables companies to address issues holistically [6, p46] . For example, tackling risks might involve improving safety training and ensuring fair wages (responding to employee feedback), targeting regions with weaker labour protections to uphold fair treatment (aligning with consumer values and brand reputation), or avoiding regulatory fines and loss of investor confidence (incorporating civil society insights). At the same time, pursuing opportunities—such as reducing employee turnover, boosting productivity, and attracting long-term investments—can create both financial and positive societal impact.

This process shows how impact materiality can uncover financial materiality, and vice versa. Stakeholder engagement serves as a bridge, turning insights into actionable strategies that connect social and environmental responsibility with financial resilience. By continuously listening to and learning from stakeholders, companies can ensure they fully understand and address both dimensions of materiality [6, p26, 46] .

Reliable and Impactful Sustainability Reporting Depends on Continuous Stakeholder Engagement

Stakeholder engagement is the foundation of effective sustainability reporting [6, p46] . Insights from a collective approach not only improve decision-making and strategy development after completing a DMA but also shape the content and focus of future annual reports.

Stakeholders help identify the most material topics to address, explore, and develop, while helping companies identify which disclosure metrics are the most useful to track. This ensures sustainability reporting is transparent, compliant, and impactful, ultimately creating long-term value for the organisation.

This process operates as a two-way flow. On the one hand, while stakeholders play a critical role in shaping and refining sustainability reporting, they need and rely on clear, reliable, and compliant information from the company to effectively evaluate the material topics and hold the organisation accountable [5, p8] . This mutual exchange ensures that sustainability reporting addresses the evolving needs of the various stakeholder groups [7, p3] . By going beyond mere compliance, companies can use this two-way flow as a strategic opportunity to build trust, align with stakeholder expectations, and create long-term value.

Proactive stakeholder engagement creates strategic advantages that drive long-term success:

- Market Adaptability & Strategic Advantage: Smart stakeholder engagement keeps companies ahead of market shifts. By listening early to customers, investors, and industry voices, businesses can adapt faster—turning emerging risks into opportunities and staying competitive.

- Stronger Investor Appeal: Companies that actively engage with stakeholders demonstrate accountability and a commitment to sustainability. This not only attracts ESG-conscious investors but can also influence lending conditions, as banks increasingly factor ESG performance into loan rates and financial assessments—providing companies with a competitive edge.

- Reputation & Risk Management: By addressing stakeholder concerns early and demonstrating accountability, companies can strengthen trust with customers, employees, and the wider public. A strong reputation built on transparency and responsiveness can protect against potential crises and enhance brand value.

When done right, stakeholder engagement isn’t just about reporting—it’s a key driver of resilience, competitiveness, and long-term business success.

Best Practices for Stakeholder Engagement & Different Approaches per group

Engaging stakeholders effectively is key to building trust, gathering valuable insights, and ensuring long-term success. Here’s how companies can foster meaningful relationships with stakeholders:

- Involve the Right People: Successful engagement starts with bringing in a diverse and representative group of stakeholders. This includes employees, business partners, customers, investors, and civil society organizations. A wide range of perspectives leads to a more well-rounded understanding of key issues.

- Equip Stakeholders with the Right Knowledge: For engagement to be effective, stakeholders need to understand the topics at hand. Providing them with relevant information, training, or context ensures that their contributions are informed and valuable. Asking clear and purposeful questions further helps gather meaningful input.

- Turn Feedback into Action: Stakeholders need to see that their input leads to real change. Companies should integrate their feedback into decision-making, update them on how their insights are shaping strategies, and ensure their voices are reflected in the company’s direction. This builds long-term trust and credibility.

- Make Engagement an Ongoing Process: Stakeholder priorities and concerns evolve over time, especially in response to global events or shifts in societal expectations. Engagement should be continuous rather than a one-time effort, allowing companies to stay ahead of emerging issues. For example, perspectives on industries like defense and energy have shifted significantly due to geopolitical changes, such as the war in Ukraine. Regular engagement helps companies adapt to these evolving expectations.

With Impaakt, companies can streamline stakeholder engagement by centralizing feedback across all groups, capturing insights at scale, and providing targeted training to ensure high-quality input. This enables businesses to act on stakeholder priorities more effectively, turning feedback into actionable strategies.

Stakeholder Engagement Is a Crucial Catalyst for the EU’s Green Economic Transition

To fully grasp the importance of stakeholder engagement, it’s essential to align it with the EU’s broader vision: the Green Deal. The Green Deal aims to decouple economic growth from resource-intensive practices, transitioning to a competitive, net-zero emissions economy by 2050 [2, p1] . This green transition requires action at all levels of the economy [2, p16] —not just through national legislation but also through the ability of companies to grow sustainably while engaging the society at large.

The two-way flow explored earlier—between stakeholder engagement and transparent sustainability reporting, as well as the interplay between impact and financial risks and opportunities—reveals a critical pattern: building resilience by prioritizing sustainable growth over resource exploitation. By leveraging stakeholder insights, companies can attract investments, optimize resource use, and create long-term value. The word “sustainability”, in its broadest sense, means creating a self-sustaining model that endures over time.

When companies invest in proactive, high-quality reporting and manage risks effectively—guided by stakeholder input—they contribute to their success and the broader economy [2, p4] . As transparency improves, companies with strong ESG performance may benefit from better credit ratings, leading to lower borrowing costs and increased investor confidence [7] . This, in turn, drives competitiveness and resilience across industries. The key outcomes are reduced volatility and the creation of long-term value, both of which are essential for a gradual and systematic transition to a green economy.

In summary, meaningful stakeholder engagement has far-reaching impacts that extend beyond individual companies. It fosters a healthier economy, empowers individuals, promotes social equity, accelerates environmental progress, and builds trust.