When the CSRD first emerged, it felt like we were all suddenly expected to gain a legal background overnight. The sheer volume of documentation, dense terminology, and evolving requirements created a steep learning curve for anyone involved in sustainability reporting. Yet here we are – decoding the ESRS, aligning with regulatory expectations, and striving to ensure accurate and compliant disclosures.

Navigating the CSRD and ESRS landscape requires a solid grasp of several complex concepts. Misinterpretation can lead to reporting inaccuracies and compliance risks. This article aims to demystify key terms, ensuring clarity, precision, and confidence in sustainability disclosures. Their complexity often stems from the way these concepts overlap, as well as the subjective judgment they sometimes require.

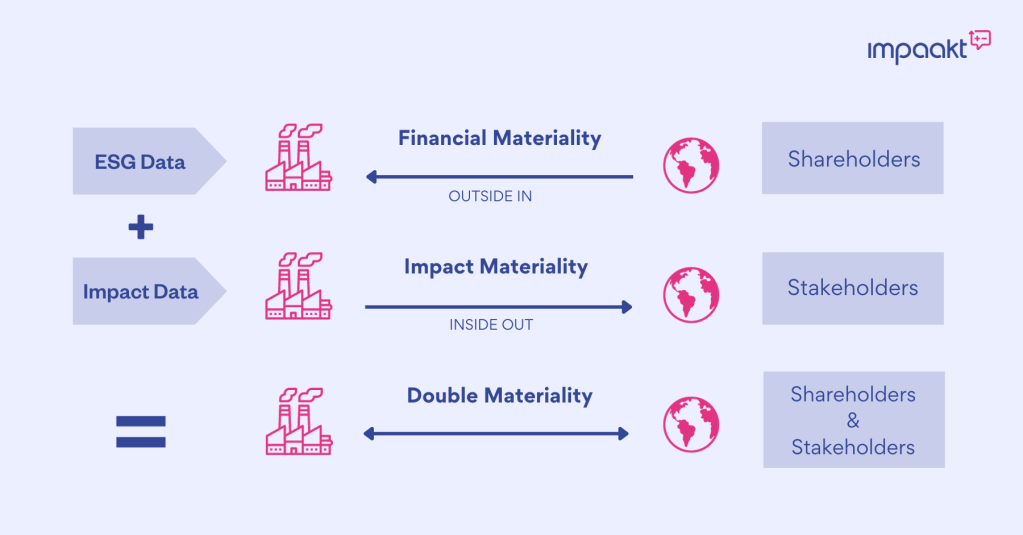

1. Double Materiality

Under the CSRD, double materiality means companies must assess and report on sustainability matters from two perspectives:

- Impact materiality: How the company’s activities impact people, the environment, and the economy.

- Financial materiality: How sustainability-related risks and opportunities affect the company’s financial performance, position, and future cash flows.

Both perspectives are equally important and must be assessed independently but reported together. This dual lens ensures that companies evaluate not only their sustainability impact but also how sustainability factors influence their financial outlook.

Companies must involve key stakeholders in this process and document how their feedback informed the materiality assessment. The process includes identifying material ESG topics at the topic, sub-topic, and sub-sub-topic level, using the ESRS framework as guidance.

2. Stakeholder Engagement

Stakeholder engagement is a critical component of the double materiality assessment. Companies must identify and engage relevant stakeholders – including employees, customers, suppliers, local communities, investors, NGOs, and regulators – to gather insights on what sustainability matters are material from both impact and financial perspectives.

Methods may include surveys, interviews, focus groups, and formal grievance mechanisms. The outcome of this engagement must be documented and inform the selection of material topics.

3. Sustainability Matters

Sustainability matters refer to the specific topics defined within the ESRS framework that relate to a company’s impacts, risks, and opportunities (IROs) across environmental, social, and governance (ESG) dimensions.

These matters are identified through a double materiality assessment, ensuring that both external impacts and internal financial relevance are taken into account. Companies must also consider stakeholder expectations, regulatory trends, and sector-specific risks.

4. Impacts, Risks, and Opportunities (IROs)

IROs refer to the sustainability issues a company must assess and report on:

- Impacts: How the company positively or negatively affects the environment, people, and society.

Example: A manufacturing company’s water discharge affects local ecosystems. - Risks: Potential threats to the company’s financial position or operations from sustainability issues.

Example: Regulatory changes related to carbon emissions increase operational costs. - Opportunities: Potential benefits the company can gain from sustainability trends or transitions.

Example: Developing sustainable products to meet growing consumer demand.

IROs must be assessed through double materiality and disclosed in the Sustainability Statement. Companies must also describe the process for identifying and prioritising these IROs, as well as any due diligence systems in place to manage them.

5. Due Diligence

Under ESRS, companies must report on their sustainability due diligence processes. This includes the policies and procedures in place to identify, assess, prevent, mitigate, and remediate adverse sustainability impacts – especially in human rights and environmental areas.

Companies must explain how these processes apply across their own operations and value chain, and how affected stakeholders are involved in decision-making or remedy.

6. Sustainability Statement

The Sustainability Statement is a mandatory section of a company’s management report where it discloses its sustainability-related impacts, risks, and opportunities (IROs) following the ESRS requirements. It must include:

- Material sustainability matters: ESG topics identified through the double materiality assessment.

- Policies, targets, and actions: The company’s strategy for managing sustainability-related risks and impacts.

- KPIs and financial effects: Key performance indicators and anticipated or actual financial impacts of sustainability matters.

Sustainability information must be included in a clearly identified and dedicated section of the management report.

7. Scenario Analysis

Scenario analysis is a strategic technique used to evaluate potential future developments by exploring a range of plausible scenarios. It helps organisations understand how different assumptions – such as climate policy shifts or market trends – could impact their business.

This approach is especially relevant for identifying climate-related risks and opportunities, a core focus of the CSRD. By modelling outcomes like varying global warming pathways, companies can better prepare and build long-term resilience.

Scenario analysis should align with defined time horizons and form part of broader risk management and strategic planning efforts.

8. Value Chain

The CSRD extends sustainability reporting beyond a company’s direct operations to include the entire value chain, both upstream and downstream.

The value chain includes all activities related to producing, delivering, and disposing of products or services. Companies must assess and disclose IROs across:

- Upstream operations: Raw material sourcing, suppliers, and business partners – including equity investments or joint ventures.

- Own operations: Internal processes aligned with the scope of the financial statements.

- Downstream operations: Distribution, product use, end-of-life treatment, and customer interactions.

9. Assessment Dimensions

In evaluating the materiality of sustainability matters, the ESRS framework requires companies to assess impacts, risks, and opportunities based on a set of assessment dimensions. These dimensions ensure a structured and comprehensive evaluation of sustainability-related topics and guide the prioritisation of disclosures.

The key dimensions are:

- Scope: The extent of the impact (who or what is affected).

- Scale: The severity of the impact (how significantly they are affected).

- Irremediability: The ability to reverse or mitigate the impact once it has occurred.

- Time horizon: The timeframe over which the impact, risk, or opportunity is expected to occur (short-, medium-, or long-term).

- Likelihood: The probability that the impact, risk, or opportunity will materialise.

- Magnitude: The potential size or significance of financial effects on the business if the risk or opportunity occurs.

These dimensions support consistent and objective sustainability assessments and help ensure alignment with broader risk management and strategic planning processes.

10. Taxonomy Alignment

The Sustainability Statement is a mandatory section of a company’s management report where it discloses its sustainability-related impacts, risks, and opportunities (IROs) following the ESRS requirements. It must include:

- Material sustainability matters: ESG topics identified through the double materiality assessment.

- Policies, targets, and actions: The company’s strategy for managing sustainability-related risks and impacts.

- KPIs and financial effects: Key performance indicators and anticipated or actual financial impacts of sustainability matters.

Sustainability information must be included in a clearly identified and dedicated section of the management report.

11. Entity-Specific Disclosure

Entity-specific disclosures cover sustainability topics not explicitly included in ESRS standards but deemed material to a company’s unique context.

Under the ESRS, companies must:

- Report on additional material topics even if not listed in ESRS

- Justify the inclusion or exclusion of these topics based on double materiality

- Ensure such disclosures complement (not replace) mandatory requirements

Entity-specific disclosures ensure flexibility and allow companies to reflect industry-specific or geographically relevant issues. They are guided by the same rigour and structure as standard disclosures.

12. Interoperability

Interoperability is the ability of different systems, frameworks, and tools to exchange and use information efficiently. In sustainability reporting, it ensures data consistency, comparability, and alignment across:

- Frameworks (e.g., ESRS, GRI, ISSB, TCFD)

- IT systems and reporting tools

- Regulatory and digital reporting formats (e.g., XBRL tagging under CSRD)

Interoperability supports efficient digital reporting, reduces duplication, and improves data quality. It is central to the EU’s sustainable finance strategy, enabling cross-framework compatibility.

13. Phase-in Disclosure Requirements

Under the CSRD, certain disclosure requirements are introduced gradually through phase-in provisions. These allow companies – especially those new to sustainability reporting – more time to comply with complex or data-heavy requirements.

Phase-ins apply to:

- Challenging data points or KPIs

- Disclosures requiring extended value chain insights

- Smaller or less experienced entities

This phased approach supports smoother adoption and encourages proactive capacity building.

14. Digital Tagging

Digital tagging refers to the process of labelling sustainability information using a machine-readable format such as XBRL (eXtensible Business Reporting Language). Under the CSRD, companies are required to tag their sustainability disclosures to enable automated processing, comparison, and accessibility by stakeholders.

Tagging is essential for:

- Enhancing data usability by regulators, analysts, and investors

- Enabling automated validation and benchmarking of disclosures

- Aligning with the European Single Electronic Format (ESEF)

Each data point in the Sustainability Statement must be tagged according to a predefined taxonomy developed by EFRAG. This facilitates interoperability and ensures that digital reports are consistent, structured, and ready for digital assurance.

15. Assurance

CSRD requires sustainability information to undergo third-party assurance to enhance its reliability. Initially, companies must obtain limited assurance, which confirms the plausibility of reported data.

Eventually, this may progress to reasonable assurance, requiring deeper verification. Assurance must be provided by an accredited independent auditor or certifier to ensure the credibility and consistency of disclosures.

Conclusion

Understanding these key CSRD and ESRS concepts is essential for accurate and compliant reporting. Companies must prioritise thorough materiality assessments, stakeholder engagement, robust data collection, and ongoing improvements in their sustainability practices. As regulatory expectations grow, clarity and consistency in reporting will be critical for transparency, accountability, and long-term business resilience.