Aligned Investments at Your Fingertips

Match your investments to your sustainability convictions

How Can Retail Investors Ensure Their Investments Align with Their Personal Sustainability Values?

Today, there is a growing disconnect between the sustainable investments offered by banks and the expectations of individual investors. Banks often impose their own frameworks and rely on ESG data that prioritizes financial materiality over real-world impact. This leaves many retail investors with portfolios that include companies they don’t view as truly sustainable based on their own convictions.

Our Approach:

Personalized Impact:

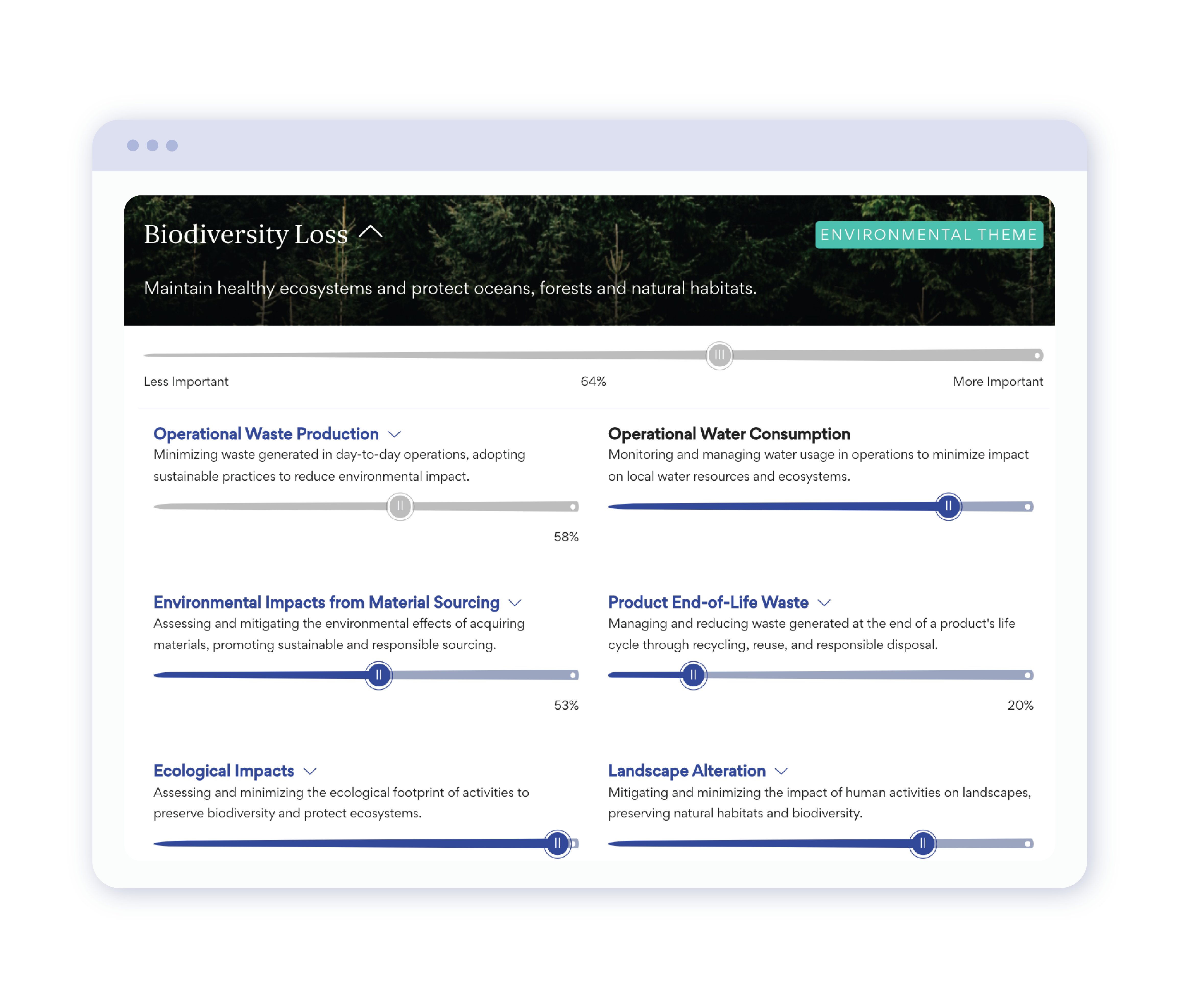

We empower investors to define their own sustainability criteria, ensuring their portfolios reflect their personal values.

Holistic View:

Our tool covers a broad range of impact areas, from climate change to biodiversity and social issues, providing a comprehensive look at sustainability.

Direct Control:

Investors gain full control of aligning their portfolios with their values, independent of bank-defined ESG metrics.

Through this tool, citizens can:

Apply their own sustainability priorities and calculate personal scores

Identify "hero" and "villain" companies based on their convictions

Find ETFs and funds that align with their personal sustainability goals

By giving control back to individual investors, we ensure that their portfolios reflect the world they want to help create.